Benefits of MSME/Udyam Registration

In India, Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the economy, contributing significantly to employment, exports, and industrial output. Recognizing their importance, the Government of India introduced the Udyam Registration (formerly known as MSME registration), a simplified process to help small businesses avail various benefits and thrive in a competitive market.

If you’re a business owner, getting Udyam Registration could be a game-changer. Here’s why:

What is Udyam Registration?

Udyam Registration is a government-issued recognition for MSMEs under the Ministry of Micro, Small, and Medium Enterprises. It offers businesses a unique Udyam Registration Number (URN) and a certificate that unlocks numerous benefits.

Any business involved in manufacturing, production, processing, or service delivery can apply for this registration.

Top Benefits of MSME/Udyam Registration

1. Access to Collateral-Free Loans

Registered MSMEs are eligible for collateral-free loans under various government schemes such as:

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- Stand-Up India

- MUDRA Loans

✅ This boosts liquidity and supports business expansion without heavy risk.

2. Subsidy on Patent and Trademark Registration

MSME-registered businesses can claim up to 50% subsidy on patent and trademark registration fees to encourage innovation and branding.

✅ Great for startups and product-based businesses wanting to protect their IP.

3. Lower Interest Rates on Loans

Banks and NBFCs offer concessional interest rates on loans to MSMEs. It reduces the overall cost of capital and encourages growth.

✅ Especially helpful for capital-intensive businesses.

4. Protection Against Delayed Payments

Under the MSMED Act, buyers must pay MSMEs within 45 days of goods/services delivery. If delayed, the buyer is liable to pay compound interest on the amount due.

✅ This ensures better cash flow and financial security.

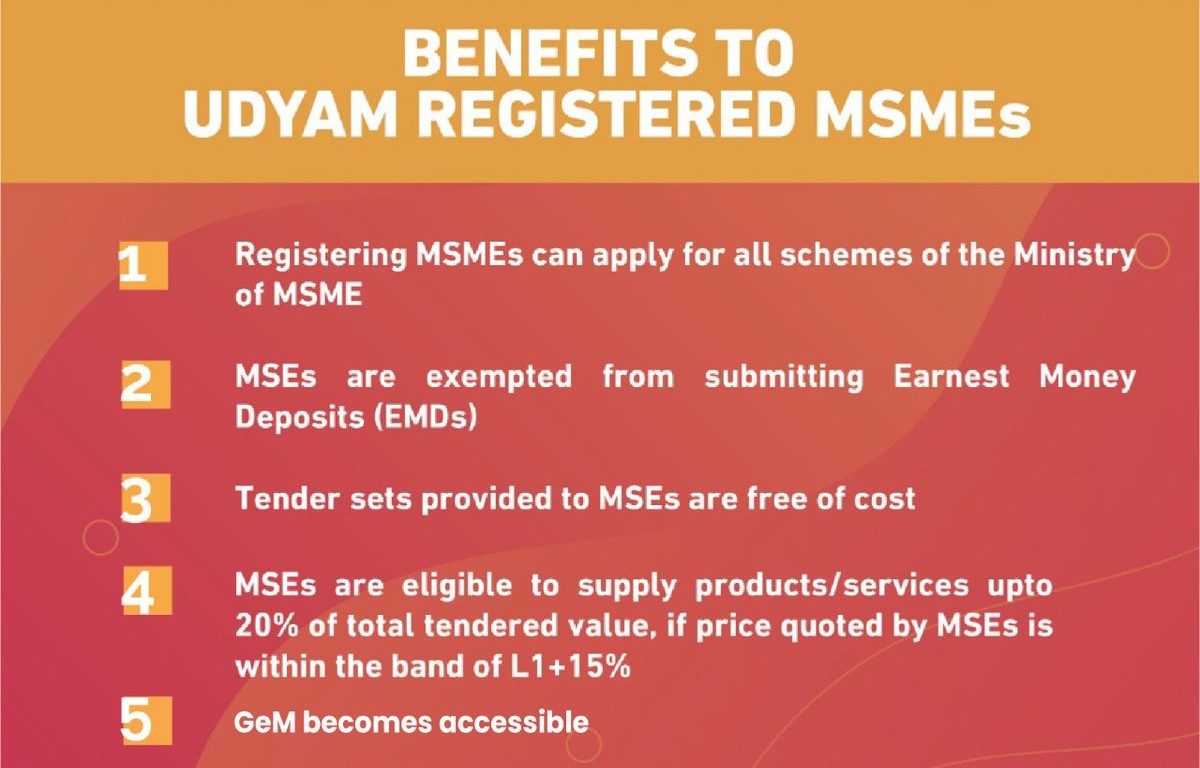

5. Priority in Government Tenders

MSMEs get preference in public procurement and government tenders. Certain tenders are exclusively reserved for MSME participation.

✅ Opens a gateway to lucrative contracts with minimal competition.

6. Reimbursement for ISO Certification

MSMEs can apply for financial assistance to get ISO certification, helping them meet global quality standards.

✅ Boosts credibility and acceptance in international markets.

7. Exemption from Certain Taxes and Licenses

In some states, registered MSMEs enjoy concessions on electricity bills, stamp duty exemptions, and waivers or rebates on registrations and licenses.

✅ Reduces operational costs significantly.

8. Credit Linked Capital Subsidy Scheme (CLCSS)

Registered MSMEs can avail of capital subsidies for technology upgrades, helping them improve efficiency and output quality.

✅ Perfect for manufacturers aiming for modernization.

9. Easier Access to Government Schemes

From Skill Development Programs to Zero Defect Zero Effect (ZED) initiatives, MSMEs get access to exclusive schemes tailored for their growth.

✅ Encourages sustainable and skilled entrepreneurship.

10. Quicker Approvals and Licensing

Many government departments offer faster processing of licenses and approvals to Udyam-registered businesses.

✅ Saves time and cuts through bureaucratic delays.

Who Can Register as an MSME?

Based on investment and turnover, businesses are classified as:

| Type | Investment (Plant & Machinery) | Turnover |

|---|---|---|

| Micro | Up to ₹1 crore | Up to ₹5 crore |

| Small | Up to ₹10 crore | Up to ₹50 crore |

| Medium | Up to ₹50 crore | Up to ₹250 crore |

Final Words

Udyam Registration is not just a formality—it’s a strategic step towards sustainable growth, government support, and financial empowerment. Whether you’re a startup, a local manufacturer, or a service provider, registering as an MSME puts you in a stronger position to compete, scale, and succeed.