What are GSTR-2B and GSTR-3B?

GSTR-2B is a system-generated statement that furnishes information about all inward supplies or purchases, including information on eligible and ineligible Input Tax Credits (ITC) for a tax period. It acts as a verification tool, auto-populated based on the GSTR-1, GSTR-5, and GSTR-6 filed via suppliers.

GSTR-3B is a self-declared monthly return that explains the business’s outward supplies, ITC claims, and total tax obligation for that month. GSTR-2B provides the reference for the available ITC, but GSTR-3B is significant for reporting the monthly tax obligations.

Before filing the GSTR-3B, Businesses are required to reconcile these two statements frequently to ensure the precision of their ITC claims. Legal issues, financial losses, and penalties are been averted from the regular reconciliation by flagging any discrepancies between the claimed and available ITC.

For maintaining compliance with GST norms and ensuring financial accuracy, the same method is important.

There Are No Secrets To Success. It Is The Result Preparation, Hard Work And Learning From Failure.

Winston Churchill…

What is the Method for Reconciling GSTR-2B with GSTR-3B?

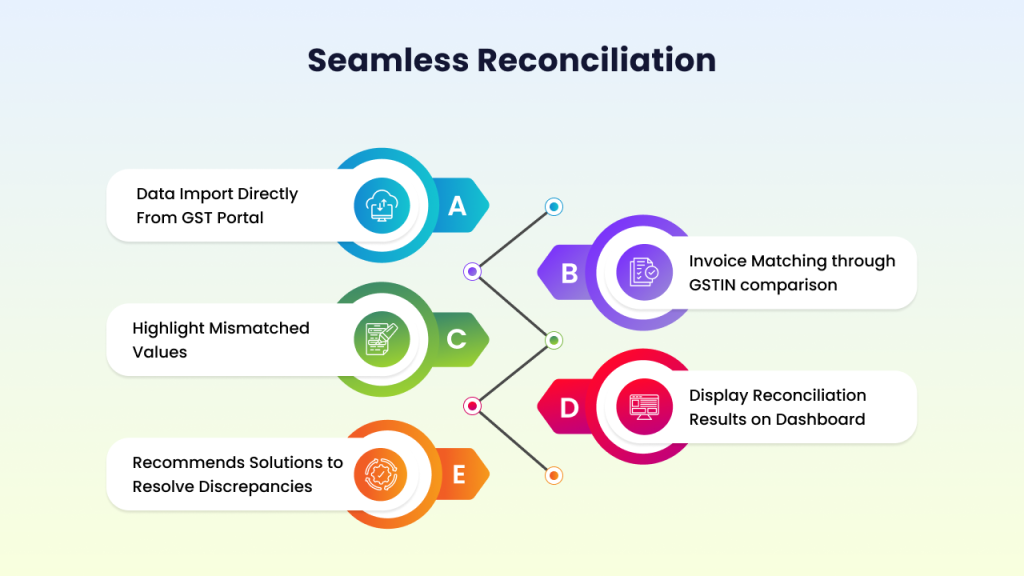

To execute a GSTR-2B reconciliation, follow these steps:

- GSTR-2B Data Download: Start by logging in to the GST portal and downloading the auto-generated GSTR-2B statement for a tax period.

- GSTR-3B Statement Draft Download: Thereafter, download the auto-drafted GSTR-3B return from the GST portal for the same tax period.

- Determine and Fix Differences: Compare the two to discover any ITC mismatches.

Using an automated GST reconciliation software will assist in finding the discrepancies here with 100% precision, as against undertaking this practice manually.

Benefits for Users:

- Save Time: Reduce manual data entry and reconciliation hours significantly

- Ensure Accuracy: Avoid costly errors and claim 100% eligible ITC

- Improve Compliance: Stay on top of ever-evolving GST regulations

- Boost Transparency: Generate clear reports for audits and internal checks

- Minimize Risk: Prevent notices, penalties, and interest due to mismatches

Conlusion:

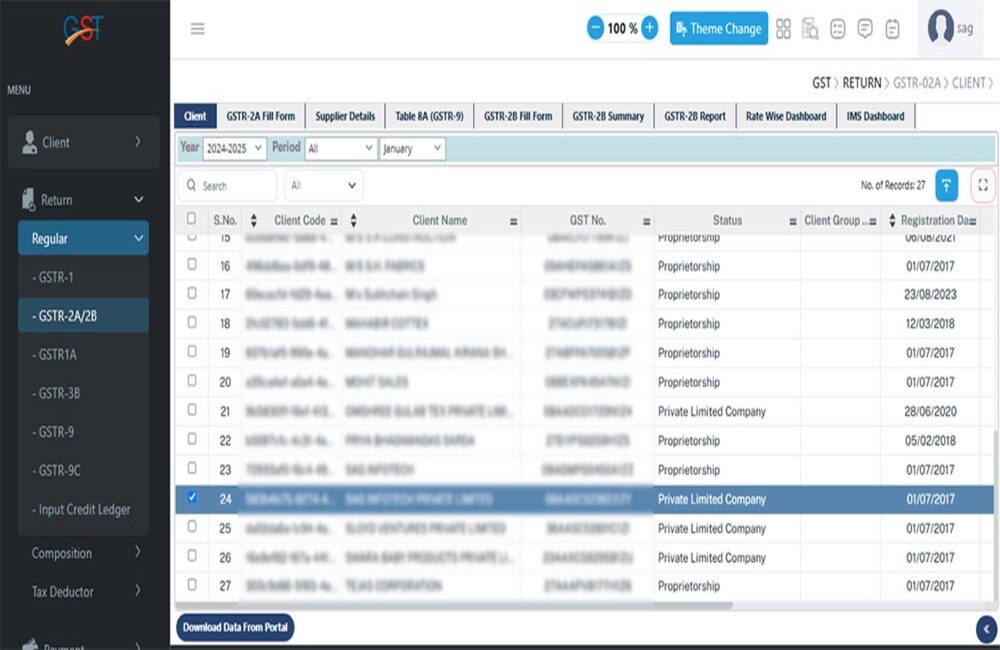

Gen GST Software transforms GSTR-2B and 3B reconciliation into a streamlined, error-free, and automated workflow. It empowers professionals and businesses to focus more on strategic tax planning while staying fully compliant. In 2025, automation isn’t just a convenience—it’s the key to efficient and accurate GST filing.