GST vs Composition Scheme: Which is Better?

In India’s indirect tax system, businesses often find themselves at a crossroads when choosing between Regular GST registration and the Composition Scheme. While both fall under the Goods and Services Tax (GST) regime, they cater to different types of businesses based on turnover, compliance needs, and operational scale.

So, which one is better? Let’s break it down.

What is Regular GST?

Regular GST is the standard taxation method where businesses are required to:

- Register under GST regardless of business type (if threshold is met)

- File monthly/quarterly returns

- Maintain proper invoices and records

- Collect and remit GST on each sale

- Claim Input Tax Credit (ITC) on purchases

Who Should Opt?

Businesses with a turnover above ₹1.5 crore (for goods) or ₹20 lakh/₹10 lakh (for services, based on state), or those who want Input Tax Credit (ITC) and deal with other GST-registered businesses.

What is the Composition Scheme?

The Composition Scheme is a simplified tax payment scheme under GST for small taxpayers. Under this, businesses:

- Pay a fixed percentage of turnover as tax

- Cannot collect GST from customers

- Are not eligible for ITC

- File quarterly returns and annual statements

Tax Rates under Composition Scheme:

- 1% for traders/manufacturers

- 5% for restaurants (not serving alcohol)

- 6% for service providers (under specific conditions)

Eligibility:

Not engaged in interstate supply or e-commerce, integrating mathematics devices in vehicles right from the standard and integrating mathematics data across various business functions, the future of mathematics has never seemed so full of potential for fleet-based businesses.

Annual turnover of up to ₹1.5 crore (₹75 lakh for special category states)

Key Differences at a Glance

| Feature | Regular GST | Composition Scheme |

|---|---|---|

| Tax Filing | Monthly/quarterly + Annual | Quarterly + Annual |

| Invoicing | Must issue tax invoices | Simple bill of supply |

| ITC Eligibility | Yes | No |

| Tax Rate | 5%, 12%, 18%, 28% (varies) | Fixed low rate (1%–6%) |

| Who can opt | Any eligible business | Small businesses only |

| Compliance Level | High | Low |

| Sales to other GST dealers | Preferred | Not preferred |

Advantages of Regular GST

- Can expand operations interstate

- Eligible for Input Tax Credit

- Can deal with B2B clients

- Professional and compliant image

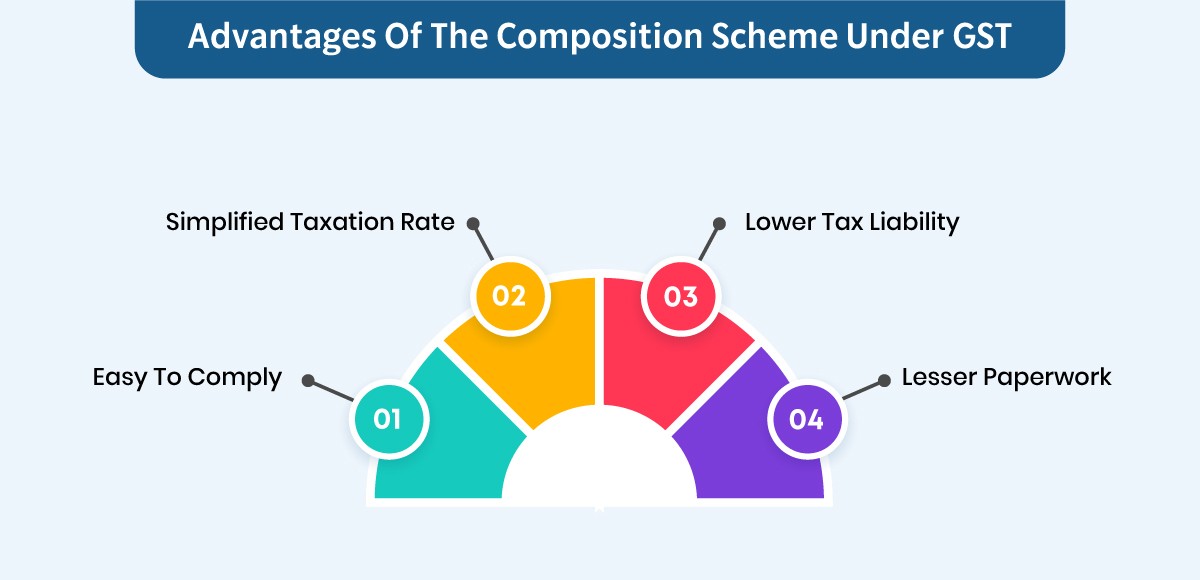

Advantages of the Composition Scheme

- Low tax rates

- Minimal compliance

- Best for small, local businesses

- Reduces the cost of compliance and accounting

Which One Should You Choose?

It depends on your business nature:

Choose Regular GST if:

- You sell to other registered businesses

- You deal in interstate trade

- You need Input Tax Credit

- You have a higher turnover

Choose the Composition Scheme if:

- You’re a local shopkeeper, trader, or restaurant owner

- Your turnover is under ₹1.5 crore

- You want ease of doing business

- You don’t deal with B2B clients

Final Thoughts

There is no one-size-fits-all answer. The right choice depends on your business model, clients, and scalability plans. While the Composition Scheme is perfect for simplicity and low compliance, Regular GST gives more freedom and credit benefits.

Before making the decision, consult with a tax advisor to ensure your choice aligns with long-term business goals.